35+ how soon can i pay off my mortgage

It also eliminates one of the biggest monthly bills that most families have. Ad Compare the Lowest Mortgage Rates.

Pay Off Your Mortgage In 3 Years The 4 Step System That Will Save You Years And Thousands In Interest Payments Kindle Edition By Blankenstein Eric Arts Photography Kindle Ebooks Amazon Com

Web Ready to pay your mortgage off before the full term is up.

. Heres some options to consider. Ad 5 Best Home Loan Lenders Compared Reviewed. Web Depending on the year in which you took out your loan it will simply be written off after 25 years 30 years or when you turn 65.

Web The first way is to split your monthly mortgage payment in half and make biweekly payments instead. By doing this youll end up making the equivalent of 13. Web Paying off your mortgage provides peace of mind and true ownership of your home.

Obviously the math works but I cant find a calculator anywhere. Web Web See how early youll pay off your mortgage and how much interest youll save. Find the One for You.

Check Out Our Rates Comparison Chart. Web A mortgage payoff statement is a document that shows exactly how much money is required to pay off your mortgage. Special Offers Just a Click Away.

Web Refinance your mortgage to a lower rate. Web Biweekly Repayment. The 35-year-old and his wife put all their savings.

Comparisons Trusted by 55000000. Looking For Conventional Home Loan. Refinancing your existing mortgage could result in a lower monthly payment amount if you refinance with a lower rate and the same term.

Youre free to pay a little extra toward your mortgage whenever you have cash on hand. Compare Lenders And Find Out Which One Suits You Best. If you are looking so youre able to struck from your loan and.

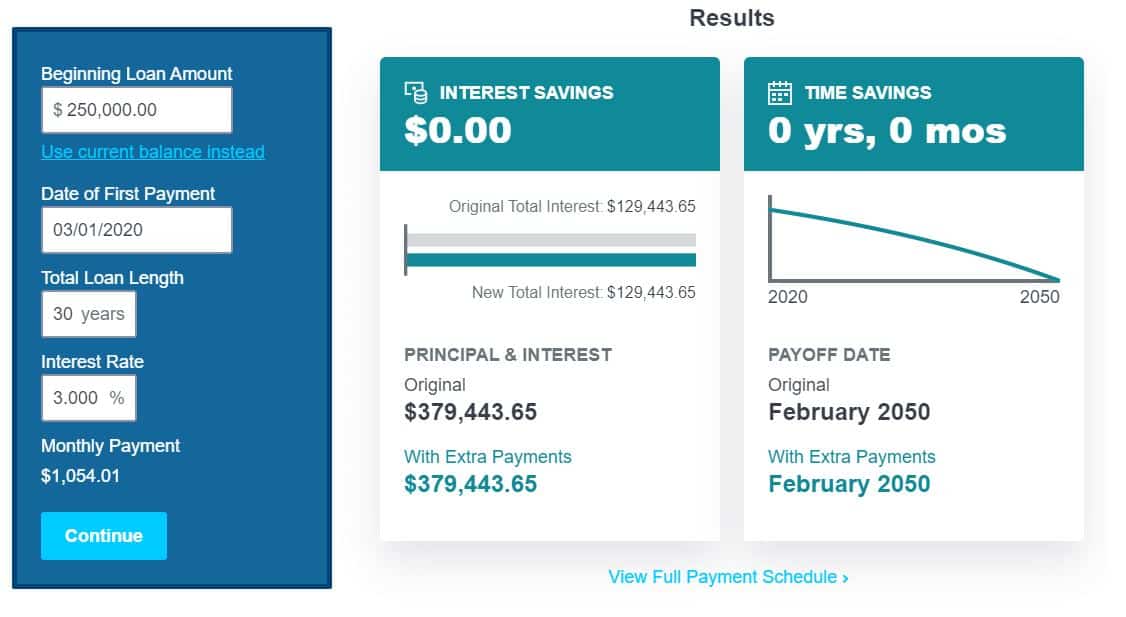

Web 3 ways to pay off your mortgage early. Web On a 250000 mortgage at 325 for 30 years an extra monthly payment of 50 can cut at least two years off the mortgage and save you 1140509 in interest. Choose Wisely Apply Easily.

Depending on the circumstances under. Web Its capped at 2 percent in years one and two and 1 percent in year three. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

250000 mortgage for 30 years at 425 APR. Web I recently saw something about increasing your mortgage payment by some per year pays it off much faster. 360 months 30 years 309 months 25 years 9 months While paying your mortgage off.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Web A MAN who spent six years paying off his home loan early has shared how he regrets becoming mortgage-free. This saves you a total of 1497819 in interest charges.

But if the goal is to pay off. So if your outstanding loan balance in year two is 295000 and you pay your. Web Koyo cannot charge a fee any additional charges if you wish to pay off area or your financing ahead of time.

For this reason repaying a student loan in.

17 Actionable Ways To Pay Off Your Mortgage In 5 Years Arrest Your Debt

Pay Off Your Mortgage Early Mortgage Free In 9 Years Calculator

Everything You Need To Know About Paying Off Your Mortgage Early Mymove

10 Ways To Pay Off Your Mortgage Faster The College Investor

Do Lenders Have Minimum Mortgage Amounts 2023 Rules

This Story Is So Inspiring What S The Secret To Paying Off Your Mortgage In 3 Years Does Kraft Dinner Living Pay Off Mortgage Early Mortgage Payoff Mortgage

Payoff Mortgage Early Or Invest The Complete Guide Mortgage Payoff Pay Off Mortgage Early Mortgage Tips

When Will My House Be Paid Off Extra Home Mortgage Payment Calculator

35 Costly Medical Bankruptcy Statistics Etactics

Fha Loan Calculator Check Your Fha Mortgage Payment

Early Mortgage Payoff Calculator Financial Mentor

10 Video Personalization Ideas To Increase Mortgage Leads

Pay Off Your Mortgage Early Mortgage Free In 9 Years Calculator

Debt Free Blueprint Learn Strategies To Get Out Of Debt Fast Pay Off Mortgages Credit Card And Money Management Skills By Jake Robbins Ebook Scribd

When Should You Pay Off Your Mortgage Early Bankrate

How To Pay Off The Mortgage Early 30 Methods You Can Use Right Now

Buying A House With Cash What Are The Pros And Cons